Can I lock rates with multiple mortgage lenders?

The online form takes only 1 3 minutes. One of the regulator’s operational objectives, laid down by law, is to ‘secure an appropriate degree of protection for consumers’. Loans are not available in all States. This tells how online lenders have a competitive edge over conventional lenders in traditional banks. Some people choose to take out a longer loan term because they will have lower monthly payments. Search our range of mortgage deals for existing customers. But benefits income is equally reliable. When you choose the best online payday loan providers, you get more than just a quick source of cash. Lenders might use soft searches on your credit file to offer you pre approved credit offers or allow you to check your eligibility for a certain credit product without impacting your credit history. Research the lending institution’s policies to see what they demand in terms of income verification, credit score minimums, loan amounts, and payback periods. “I Heard That Taking Out a Payday Loan Can Help Rebuild My Credit or Improve My Credit Score. With the best online payday loans, you can get the money you need in a matter of hours, without having to leave the comfort of your home. If you do not repay your loan it may also mean that Credit Reference Agencies CRAs will record the outstanding debt. If you’ve got a bit of spare room in your budget, and your personal loan allows it, you can increase both your repayment amount and frequency – helping you make an even bigger impact on your loan. In their assessment, the lender must consider the customer’s income and all relevant expenses. This will definitely lead to a higher approval Interior Design and Architecture News rating. YOU SHOULD TRY TO PAY EVEN MORE TOWARDS YOUR PRINCIPAL BALANCE EACH MONTH.

No credit check loans online How to apply today

To process a payday loan request, the payday lender will ask for the customer’s name, address, social security number, driver’s license or other state issued I. Register for Online Banking. B during any period of twelve consecutive calendarmonths, individuals who, at the beginning of such period, constituted the board of directors of Borrower together with any new directors whose election by the board of directors of Borrower or whose nomination for election by the stockholders ofBorrower was approved by a vote of at least two thirds of the directors then still in office who either were directors at the beginning of such period or whose elections or nomination for election was previously so approved cease for any reasonother than death or disability to constitute a majority of the directors then in office. Transparent fee structure with Cash Stop and no hidden charges. While it’s typical to see an APR of 400% or higher, some payday loans have carried APRs as high as 1,900%. Payday loans have high service fees and a short repayment period. You will have to pay back a lot more than you borrowed. 2 Interest Rates: Interest rates also vary by lender but tend to range between 15% 30% APR annual percentage rate. Alternatively, if you have little to no credit information e. When a company issues a bond it guarantees to pay back the principal face value plus interest. A special rule applies when the consumer’s principal dwelling securing a consumer credit transaction is in foreclosure. Get a personal loan to consolidate debt, renovate your home and more. Here we discuss its uses along with practical examples. After months of violent protests, there is a lull on the streets. The actual Lender is an unaffiliated third party. These guides will help you manage your money and learn more about the types of loans available.

Asda Money

What do I need to apply. The interest rates on title loans are often very high, which can make it difficult for borrowers to repay the loan. E mail addresses and toll free telephone numbers are usually the only way you’re able to contact the payday lender. This speed of borrowing $100 can help you sidestep overdraft fees as well as the potential damage to your credit score that comes from missing or bouncing important bill payments. You may have heard of some of the industry’s top no credit check loan companies by now. Don’t be persuaded by promises of same day payday loans, no credit check options, and more. Self Introduction: How Do You Start, Do’s and Don’ts. They have made the process from acceptance to receiving your money as streamlined as they can. If you took out the loan between June 2005 and February 2011, the rules are slightly different. Read a summary of privacy rights for California residents which outlines the types of information we collect, and how and why we use that information. You can sign the mandate electronically if your bank enables it. Payday UK will not charge you any fee. Your recent columns about when to take Social Security show a disparity of views with each point being valid for that specific individual. Find out how much you can save by switching to a Godrej Capital Home Loan today. 50% of the principal outstanding and undisbursed amount if any + applicable taxes/statutory levies at the time of conversion. With MoneyMutual, you can get payday loans online no credit check instant approval in as little as 24 hours. Rates, terms and conditions are as of 4/10/2023 and are subject to change at any time. A credit score or rating is a number between 0 and 1,000 that tells businesses how likely you are to pay your bills or your loan repayments on time. You will need to provide some basic information about yourself and answer some questions about your financial expenditure each month, such as your housing, food and travel costs. You do not need to include alimony, child support, or separate maintenance income unless you want it to have it considered as a basis for repaying a loan. To dodge undesired credit checks, survey the lender’s conditions. This snowballing effect of the interest rates is simply because these collateral free loans are sanctioned to the borrowers without any guarantee. You can see your eligibility rating for personal loans when you compare them with Experian. After 5 to 10 minutes of filling up my application, my loan has been approved and the money was in my bank account.

FOLLOW US

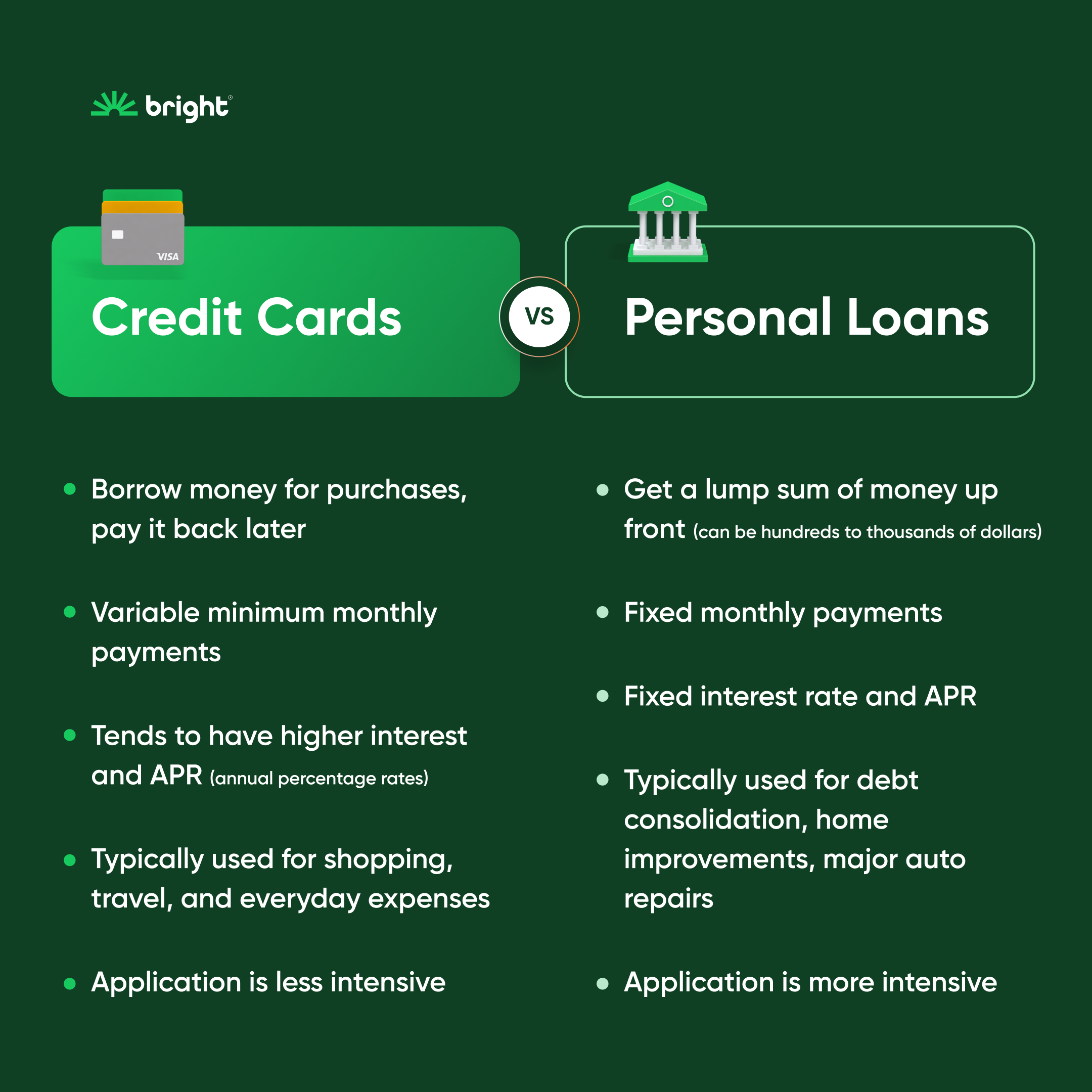

Visit a Branch today and learn more from one of our knowledgeable and friendly Tellers. Debt consolidation: An installment loan can roll other unsecured debts, including high interest loans and credit cards with revolving credit, into a single, fixed monthly payment. Approval rates for applicants are 80%. Here are five reasons you should apply for a Montana payday loan. The greatest online payday loans are available to borrowers through this service, and the application procedure takes just a few minutes. Please refer to the Group Policy for a full explanation of the terms. We may arrange for third party service providers to use cookies to analyse traffic to our website. In other words, we recommend that you be careful and pay it back on time. A breakdown of categories for your budget and how much to spend on each type of expense. The full archive recording shares The Budgetnista’s powerful story – and her support of GreenPath, a trusted nonprofit resource for 60 years,. Send us a message and we will get back to you. Dept@finance monthly. Sometimes you just need access to a quick loan that provides flexibility and convenience. We specialise in helping people with poor or bad credit. In that instance, you should contact the company or the lender. Loans on the Same Day for Business Owners. Calculate your home’s equity to see if you’d qualify to borrow enough to cover your outstanding debt. See your local branch for more information and additional disclosures.

Important Legal Disclosures and Information

The loan amortization schedule will show as the term of your loan progresses, a larger share of your payment goes toward paying down the principal until the loan is paid in full at the end of your term. IMF lending also aims to protect the most vulnerable population via policy conditionality. You are encouraged to consult your state’s consumer information pages to learn more about the risks involved with cash advances. If the company is reputable, the loan offer is generous and the eligibility requirements are easy to satisfy, then it’s time to review the loan terms and the contract. Error: The maximum length of a loan in these circumstances is 7 years. 99%, lender dependent. Key findings in the 2020 Annual Report of Payday Lending Activity Under the California Deferred Deposit Transaction Law, include: i nearly 61. The APR for these loans can range from 5. ClearCash is here to help with quick and easy ongoing access to cash. Find retail and consumer direct mortgage lenders on Zillow’s mortgage marketplace. Find out how much money you can borrow from your state’s regulations. Credit scores fluctuate based on a consumer’s financial activity so my advice is not to get too obsessed with trying to achieve a perfect score – practice positive financial behavior and the score will reflect that and generate a good score that will allow a consumer to achieve his/her financial goals. Some lenders impose prepayment penalties if a borrower pays off their loan early. Our registered FRN is 662397. Fees and Interest Rates Applied to Low Interest Loans for Bad Credit with APRs. However, the effect of behavioral biases on expert forecasts is generally ignored. Loan Request Terms: 1F Cash Advance is intended to function as an advertising referral serviceand serves as a connecting platform between its users who may be potential borrowers and qualified participatinglenders. One: we receive “affiliate” commissions when readers click on anadvertiser’s links within our content and purchase the advertiser’s product or service. Like many borrowers, Janis Brown went to one payday lender to get help paying the fees of another. The illustrative APR is the lowest rate available for the selected loan amount. Consumer Financial Protection Bureau, via Federal Register. This information may be different than what you see when you visit a financial institution, service provider or specific product’s site. With much more reasonable rates than cash advance lenders, a PayDay Loan is your best choice when you just can’t wait until payday. Read on to find out more about borrowing money from Dot Dot Loans and how quickly you could get the money you may need. Part of the purchase price of a property that is paid in cash and not financed with a mortgage. Thus, MoneyMutual is the best option for you when you are seeking a loan for the first time and require any help. The quickest and most effective way to protect yourself from online loan scams is by trusting our ranking.

Sort:

You may apply for such an installment loan up to $5000 with Ipass even if you have a bad credit score or haven’t been able to build credit. Although, if you do get confused, you can ask the examiner for confirmation of where you’re going. Not only that, but my 2012 MacBook Air was not able to run the latest Lightroom, and the older Lightroom version I had was not able to decode the new raw image format. It could be the solution to your current financial situation. I sold my home 6/18/06 to my ex husband after a divorce. But some credit card companies — especially newer startups in the space — are advertising both no credit check and no fees of any kind. To apply, you’ll typically need to be a credit union member for at least one month. Founder and Financial WriterUpdated on April 18, 2023. If you are approved for the personal loan, you would simply use funds from your new personal loan to pay off your existing payday loans at a lower interest rate. We conduct periodic account reviews and increase credit limits where customers have demonstrated their ability to meet their credit commitments in a responsible manner. £200 loans and other finance opportunities offer a lift for minor expenditure, but what if you need a bigger boost. Not all installment loans are the same. Myth: Making the minimum payments on loans is better than paying off your credit card balance every month. There are a few credit scoring models that you can use to check your credit score, but the FICO credit scoring system is one of the most popular. When you need cash fast but want to repay over a longer period, personal loans repaid in installments are the right product for you. You can pay money into it whenever you like and redraw it if you need to. 0% of the loan amount and they take it off the top of your loan funds. Best online payday loans are also great for those with bad credit or no credit. Representative example. Escrow Holdback: Funds retained by the escrow company after the close of escrow until repairs and/or required termite work has been completed. If you’re not currently enrolled in Online Banking, visit a financial center or schedule an appointment to apply for your loan.

The importance of high quality data for risk decisions

MoneyMutual is the best online payday loan provider, offering customers the ability to access short term loans quickly and easily. Debt management plans: Nonprofit credit counseling agencies like InCharge also offer a service, at a monthly fee, to reduce credit card debt through debt management plans. To know if you could get a payday loan, start with filling out your state in the form provided above. Another reason is the lack of oversight. Whether it’s £100 loan or a £10,000 loan you are looking for Apply online and we can give you a quick decision and you could have the cash sent to your bank in minutes. You are eligible to avail a car loan if you meet the below criteria. Once they repay the loan, the account is closed. Maximum 300 characters. In an article entitled, Fraud and Abuse Online: Harmful Practices in Internet Payday Lending, “one issue which was never raised during a Federal Trade Commission Workshop in any of the discussions the fact that payday loans do not hurt equally. God service og greie tilbakemeldinger. As Syndication Agent for the Term A Loan Facility, and. Applying for a loan can be a great way to help you manage your financial situation. A payday loan is typically for a smaller amount — usually under $500.

Will I be charged any fees?

It’s as simple as that. The repayment facility is linked with debit or credit transactions Point of Sales POS machines installed at retail shops, grocery stores, supermarkets, and shopping malls. The words “we,” “us,” and “our” refer to us along with our agents, with whom we have contracted to facilitate payments to your Accounts. As long as we see that you can afford the loan in your budget, we are happy to help you access the emergency funds you need. 49 percent and go as high as 35. The One Stop Money Shop proudly offers instalment loans as a direct lender, meaning that we can process your application from start to finish, transfer funds and take collections too. News and MarketWatch. 14 September 2022 2 min read. And they use your credit score to determine how likely you are to repay it. Payday loans become cash advance, charge card cash advance, and possess sales. Personal loans should be used only for unexpected financial needs, not as a long term financial solution. The biggest and so far the only challenge that the fintech industry is facing is spreading awareness about the benefits and the products that it is offering. A detailed help section offers guidance on each step of the application. We encourage other search engine providers to follow suit so the popular platforms that people use online can also be trusted to direct them to responsible lenders.

Sitemap

If your name was on a deed, you had interest in that house. Fees are typically around 4% rather than the 2 3% that is common with balance transfers. Take control of your finances and use our online payday loan platform. You cannot pay off a payday loan with another payday loan. Here’s what goes into a typical balance transfer offer, using the Wells Fargo Active Cash® Card Rates and Fees as an example. CashLady is a registered Trading Name of Digitonomy Limited, Registered in England and Wales Company number 08385135, Registered Office; Steam Mill Business Centre, Steam Mill Street, Chester, Cheshire, CH3 5AN. April 12, 2023 The New Jersey Economic Development Authority NJEDA will host a virtual public information session on the New Jersey Clean Energy Loans NJ CELs Program on Monday, April 17 at 1:00 p. Get your Lifetime Free Credit Card Now. If you have a bad credit score 629 or lower, you may still be able to get an installment loan on your own, but there are things you can do to boost your chances of qualifying. Loans starting from Rs. Although full details are contained in our Privacy Policy, we wanted to draw your attention to the following important points. Title loans are popular for two key reasons. We may also receive payment if you click on certain links posted on our site. What makes something an “easy simple loan” is naturally going to be subjective, depending on the customer’s prior experiences, preferences, and expectations with the lending process. Loans with shorter terms usually have lower interest costs but higher monthly payments than loans with longer terms. By working this way, lenders are able to offer bad credit quick loans online as their decisions are not solely based on your credit rating. Get your goals on track today with a bad credit cash advance loans. Pepper Money variable interest rates range from 5. Compare lenders’ APR ranges and pre qualify with multiple lenders to see which one makes you the best offer. If you need to borrow money and are thinking of a payday loan, stop to consider your options. Some lenders offer small loans with APRs below 36% — the maximum rate that consumer advocates say is affordable — but others charge rates well above that and may put borrowers at risk of defaulting. Terms and Conditions Privacy Policy. As part of a move to get your finances back under control, you might be wondering if there are steps you can take to reduce your monthly personal loan repayments. Refinancing is not available in Nevada, or for Mississippi or Tennessee Pledge products. At the same time, we understand that additional credit over and above your existing credit limit may not always be something that you are looking for. They have earned a great reputation as one of the most reliable online money lending services available.

Loan Details

The card also comes with no annual fee. If you have bad credit and need money quickly, explore other low cost options first. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact checked to ensure accuracy. Typically it is one report a year, but you can currently get a free report on a weekly basis. We want to help our customers make an informed decision about their finances, so that you can make the best choice to resolve your short term position. 74% Our APR includes all applicable fees. Our personal loans reward you for good behavior instead of trapping you in an endless spiral of interest and penalties. Lowest APR is available to borrowers with excellent credit. This lending platform also considers borrowers with poor credit and six or more months in business. The company’s lenders offer reasonable alternatives to traditional loans. But you won’t have the luxury of visiting a branch and speaking with a loan officer face to face like you would with a bank or credit union. Again, the type of loan you want may dictate your choice of a lender. Some are secured, which means they are backed by something you own, like your house or car. Payday loans include high interest rates and expenses that make it challenging for borrowers to pay and escape debt. These loans come with high interest rates and are often used for unexpected expenses or emergencies. All the same, you should always remember, there are affordability checks conducted by the bank to state if you are eligible for the loan amount you ask. The advertisements might run for a couple of weeks before Google blacklists the website, Rodnitzky said. Before you apply for a cash loan via The Money Shop, there are a few things you should know. We have found a great re financing match with CarZing. One of the key factors considered when applying for a loan is the borrower’s credit score. All you need to do is to log into your account online and enter the amount of money that you need to borrow, subject to a minimum of £25. Explain your situation and ask for an extension, lower rates, a different payment schedule or have them waive extra fees — they may be willing to work with you. The good news is that many lenders allow you to apply for a mortgage, car loan or personal loan online. Through a loophole in Federal Reserve rules, institutions with bounce protection programs don’t disclose how expensive these fees can be, charging up to 1,000% APR. The typical fees are approximately $10 to $30 for every $100 borrowed. Your installment loan payments come from the same account automatic, no hassles. This confirms your likelihood of being accepted for the loan or not – Lenders use soft search, which means they check your credit report without leaving a mark. Drive Thru Hours: Monday Friday: 9:00 A.